Trading is a cornerstone of modern economies, facilitating the exchange of goods and services between individuals, companies, and even countries. Over the years, trading has evolved from physical exchanges in marketplaces to largely digital transactions occurring on electronic platforms. With the rapid advancement of technology, the future of trading is set to undergo even more transformative changes, impacting the industry in various ways.

Technology has already revolutionized trading in numerous ways, making it faster, more efficient, and more accessible. The rise of electronic trading platforms has allowed traders to execute transactions in milliseconds, compared to the minutes or hours it would take to place a trade on a physical trading floor. Automated trading algorithms now dominate the markets, conducting trades based on pre-established instructions and parameters without the need for human intervention. This has led to increased liquidity and reduced transaction costs, benefiting both individual traders and institutional investors.

Another key development in trading technology is the rise of artificial intelligence (AI) and machine learning. These technologies are increasingly being used to analyze vast amounts of data and identify trading patterns that would be impossible for human traders to discern. AI-powered trading systems can execute trades at lightning speed and with greater accuracy, reacting to market changes in real time. This has led to the development of predictive trading models that can forecast market trends and help traders make more informed decisions.

Blockchain technology is also poised to have a significant impact on the future of trading. The decentralized and tamper-proof nature of blockchain makes it an ideal platform for conducting secure and transparent transactions. In the world of trading, blockchain can be used to create smart contracts that automatically execute trades when certain conditions are met, eliminating the need for intermediaries and reducing the risk of fraud. Blockchain-based trading platforms are already gaining traction in the industry, promising to revolutionize the way trades are conducted and settled.

The future of trading is also likely to see the integration of virtual reality (VR) and augmented reality (AR) technologies. These technologies have the potential to transform the way traders interact with financial markets, making it possible to visualize and manipulate complex data in immersive environments. Traders could use VR to navigate through market data, analyze trends, and execute trades with a few gestures or voice commands. AR could also be used to overlay real-time market information onto physical objects, providing traders with a more intuitive way to monitor and react to market changes.

In addition to technological advancements, the future of trading will also be shaped by regulatory changes and shifts in consumer behavior. The increasing digitization of trading has raised concerns about data security and privacy, leading to calls for greater regulation and oversight. Regulators are also grappling with the rise of cryptocurrencies and other digital assets, which have the potential to disrupt traditional financial markets and trading systems. As a result, we can expect to see stricter regulations and new compliance requirements being put in place to ensure the integrity and stability of trading platforms.

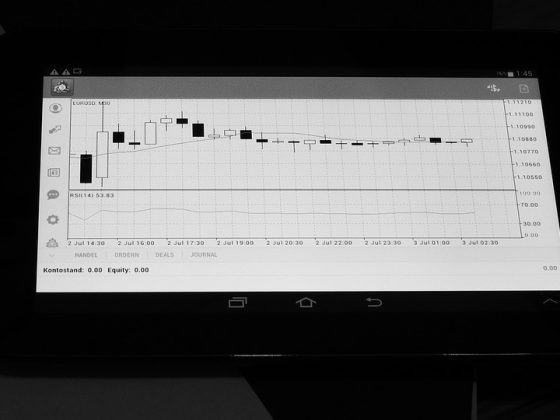

On the consumer side, the growing popularity of mobile trading apps and online trading platforms has democratized trading, making it accessible to a wider range of individuals. Retail investors now have the ability to trade stocks, commodities, and currencies from the comfort of their own homes, without the need for a traditional brokerage account. This trend is likely to continue as technology advances and trading platforms become even more user-friendly and intuitive.

Overall, the future of trading is bright, with technology playing a central role in shaping the industry. From AI-powered trading algorithms to blockchain-based platforms, the next decade promises to bring even more innovation and disruption to the world of trading. As traders adapt to these changes, they will need to stay informed and embrace new technologies to stay competitive in an ever-evolving market landscape.

—

FAQs:

Q: What are the most significant technological advancements shaping the future of trading?

A: Some of the most significant technological advancements in trading include electronic trading platforms, artificial intelligence, blockchain technology, and virtual reality/augmented reality.

Q: How is blockchain technology expected to impact trading?

A: Blockchain technology is expected to revolutionize trading by providing a secure and transparent platform for conducting transactions. Smart contracts and decentralized exchanges powered by blockchain have the potential to streamline trading processes and reduce the risk of fraud.

Q: What are the regulatory challenges facing the future of trading?

A: Regulatory challenges facing the future of trading include data security and privacy concerns, as well as the rise of cryptocurrencies and digital assets. Regulators are working to create new rules and compliance requirements to ensure the integrity and stability of trading platforms.

Q: How can individual traders adapt to the technological changes in trading?

A: Individual traders can adapt to technological changes in trading by staying informed about new developments and embracing new tools and platforms. It is important for traders to be open to using AI-powered trading algorithms, blockchain-based platforms, and other innovations to stay competitive in the market.