Surviving a Recession: Practical Steps to Protect Your Finances

The economy is cyclical, and periods of recession are inevitable. A recession occurs when there is a significant decline in economic activity over a sustained period. During these challenging times, individuals and families may find themselves facing financial uncertainty and stress.

While it can be overwhelming to navigate through a recession, there are practical steps you can take to protect your finances and weather the storm. By being proactive and making smart financial decisions, you can minimize the impact of a recession on your financial well-being. Here are some practical steps to help you survive a recession:

1. Create a Budget

During a recession, it's more important than ever to have a clear understanding of your income and expenses. Creating a budget can help you track where your money is going and identify areas where you can cut back on spending. Take the time to review your expenses and prioritize essential needs such as housing, food, and transportation. Consider cutting back on non-essential items like dining out, entertainment, and shopping.

2. Build an Emergency Fund

Having an emergency fund is a crucial part of financial preparedness, especially during a recession. Aim to save at least three to six months' worth of living expenses in an easily accessible account. This fund can help cover unexpected expenses or bridge the gap in income during a recession. If you don't already have an emergency fund, start by setting aside a small amount each month until you've built up a comfortable cushion.

3. Pay Down Debt

High levels of debt can be a significant source of financial stress during a recession. Focus on paying down high-interest debts such as credit cards and personal loans. Consider consolidating or refinancing your debts to lower your interest rates and streamline your payments. By reducing your debt burden, you can free up more of your income for savings and essential expenses.

4. Diversify Your Income

Relying on a single source of income can leave you vulnerable during a recession. Consider diversifying your income streams by taking on a side hustle, freelance work, or part-time job. This additional income can help supplement your primary source of income and provide a buffer during challenging times. Look for opportunities to monetize your skills, hobbies, or interests to generate extra cash.

5. Review Your Investments

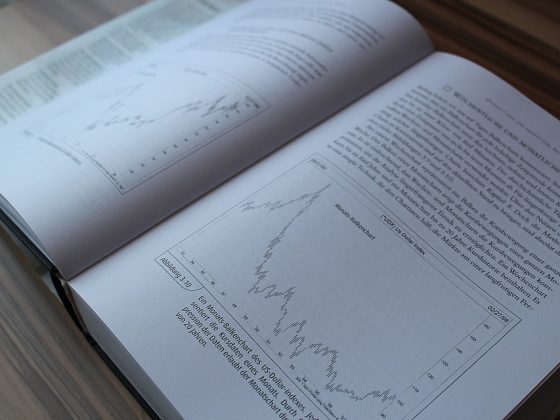

If you have investments in the stock market or other financial assets, it's essential to review your portfolio during a recession. Consider rebalancing your investments to reduce risk and protect your assets. Diversifying your portfolio across different asset classes can help spread out risk and minimize losses during volatile market conditions. Consult with a financial advisor to ensure your investments align with your long-term financial goals.

6. Negotiate with Creditors

If you're struggling to make payments on your debts or bills, don't hesitate to reach out to your creditors for assistance. Many companies offer hardship programs or payment plans for individuals facing financial hardship. Contact your creditors to discuss options for reducing or deferring payments, negotiating lower interest rates, or restructuring your debts. Being proactive and open about your financial situation can help you avoid late fees, penalties, and defaulting on your obligations.

7. Focus on Essential Needs

During a recession, it's important to prioritize essential needs and cut back on discretionary spending. Evaluate your expenses and identify areas where you can reduce costs, such as dining out, travel, subscriptions, and luxury items. Focus on meeting your basic needs such as food, shelter, utilities, and healthcare. Look for ways to save money on groceries, utilities, insurance, and other essential expenses to stretch your budget further.

FAQs:

Q: What is a recession, and how does it impact individuals and families?

A: A recession is a period of economic decline characterized by a decrease in consumer spending, business investment, and overall economic activity. During a recession, individuals and families may experience job loss, income reduction, increased cost of living, and financial stress. It can be challenging to make ends meet and maintain financial stability during a recession.

Q: How can I protect my finances during a recession?

A: To protect your finances during a recession, it's essential to create a budget, build an emergency fund, pay down debt, diversify your income, review your investments, negotiate with creditors, and focus on essential needs. By taking proactive steps to manage your finances, you can minimize the impact of a recession on your financial well-being.

Q: What are some strategies for managing debt during a recession?

A: To manage debt during a recession, consider prioritizing high-interest debts, consolidating or refinancing your debts, negotiating with creditors for more favorable terms, and seeking assistance through hardship programs or payment plans. Focus on paying down debt to reduce financial stress and free up more of your income for savings and essential expenses.