Saving seems like an impossible hurdle when you’re struggling to make ends meet and have to search for quarters under the couch to pay your electric bill. I get it (I write for a living, after all—I’m not driving a Lamborghini).

However, finding ways to build your savings and even start investing is the only way you’re going to get off the paycheck-to-paycheck struggle bus.

Here are a few ways you may be able to find a few extra dollars to save every week

Buy Cheap Staple Foods in Bulk and Meal Prep

Food is one of our most controllable monthly costs, so that’s where we’ll start. Meal prepping—spending time on your days off to prepare lunches and dinners for the week—is a great way to bring your food costs down without becoming malnourished on instant ramen.

Meal prepping works well for several reasons: (A) you save money by cooking from scratch instead of buying frozen dinners or takeout, (B) you save time by making and freezing multiple batches ahead of time, and (C) you can plan healthier meals, because being healthy is also good for your finances, by the way.

Typically, the costs per pound go down when you buy larger amounts of staple foods. Start by stocking your pantry with these ingredients:

- Rice (ideally brown)

- Dried beans

- Pasta (ideally wheat)

- Frozen veggies

- Lentils

- Oats

- Flour

- Oil

- Peanut butter

- Coffee if you drink it (much cheaper to brew your own)

Once you’ve built a base of nonperishable staples, you can supplement with occasional trips to the store to replenish perishables. I’d also recommend building an arsenal of herbs and spices to make your flavors more interesting.

As far as recipes go, I regularly visit the subreddit EatCheapAndHealthy to get new ideas, but things like oatmeal, pancakes, soup, burritos, curries, and stir-fries are extremely simple and cheap ways to start. Learn to bake your own bread; it’s a rewarding skill to have and it’s actually fun.

You can even try to duplicate your favorite takeout or fast-food orders—I use spaghetti to make a lo mein duplicate for 1/5th the cost.

Turning yourself into a frugal master chef is also a pretty solid way to impress family/friends/dates, if you need extra convincing.

Audit Your Subscriptions

Recurring subscriptions can be one of the biggest invisible drains to your bank account. In some cases, you may not even remember you have a subscription until you see the monthly or annual charge hit.

There are a few things you can do to avoid hemorrhaging subscription money. First, regularly review all charges on your debit or credit cards.

Not only will this keep you aware of subscription payments; it’s also a good habit to check for fraud if you see any purchases you didn’t actually make.

Second, don’t keep multiple subscriptions with overlapping purposes. Sure, you might already have saved money by canceling cable and using Netflix and Hulu instead—but there could still be room for improvement.

You could choose one of them to keep first and work through all the top shows you want to see, then cancel and switch.

Or, you could even try out some of the free (and safe and legal) streaming sites out there, like Yahoo View, Crackle, Tubi, and Vudu. Offerings will usually be more limited and you may have to deal with ads, but it’s more money in the bank!

Lastly, it might go without saying at this point, but cancel any subscriptions that you aren’t actually using. It might be Amazon Prime, a premium music service, a magazine, or a gym membership you keep meaning to use.

Whatever it is, funnel the cost into savings or investments instead. You may be surprised how much you’ll accumulate in a year.

Buy and Sell at Thrift Stores and Secondhand Sites

When you need to buy something—from a winter coat to necessary household goods—it can save you a ton of money to get them secondhand.

You can often even score name-brand items in good condition for a fraction of the original prices.

Some people are able to bring in extra income by reselling thrifted items online, but this usually works best when you have good foundational knowledge of certain types of products and can eyeball what will sell and what won’t.

Otherwise, you might spend money you don’t have on inventory that just sits around your house.

However, if you already have items sitting around your house, you might as well see what you can sell. Uncluttering your living space and adding to your savings is a win-win.

Poshmark, eBay, and Facebook Marketplace are a few places where you can list items to sell.

Consider Adding Roommates

This isn’t an ideal option for everyone, especially if you already live with other people or there are other reasons preventing a move.

However, if you’re truly struggling to make ends meet and are running out of other options, weigh the idea. It’s usually the case that the more people you live with, the cheaper costs become for everyone.

For instance, you might have the option of renting a one-bedroom apartment by yourself for $750, or a $1500 four-bedroom place with three roommates.

With the first option, you’re paying $750 plus all utilities. With the second option, your rent drops to $375, and you share costs like heating and electric.

Now, how pleasant this experience is for you all depends on the people you end up with. It seems like everyone has a horrible roommate story. Some never wash their dishes.

Others have the TV too loud at 2 a.m. Others just don’t mesh well sharing space. However, you might also find that you enjoy living with roommates and get along well.

It can be a roll of the dice, but if you happen to end up with a bad roommate—as long as they’re not legitimately dangerous or toxic—take a deep breath and think about the hundreds of dollars you’re saving (and the future stories you’ll get to tell).

Use Free Cash Back Apps Whenever Possible

Technology is pretty amazing, especially when it gives you money for free. There are several types of apps you can use to earn cash back when you do your regular shopping, like getting groceries.

Scan your receipts with cash-back grocery apps

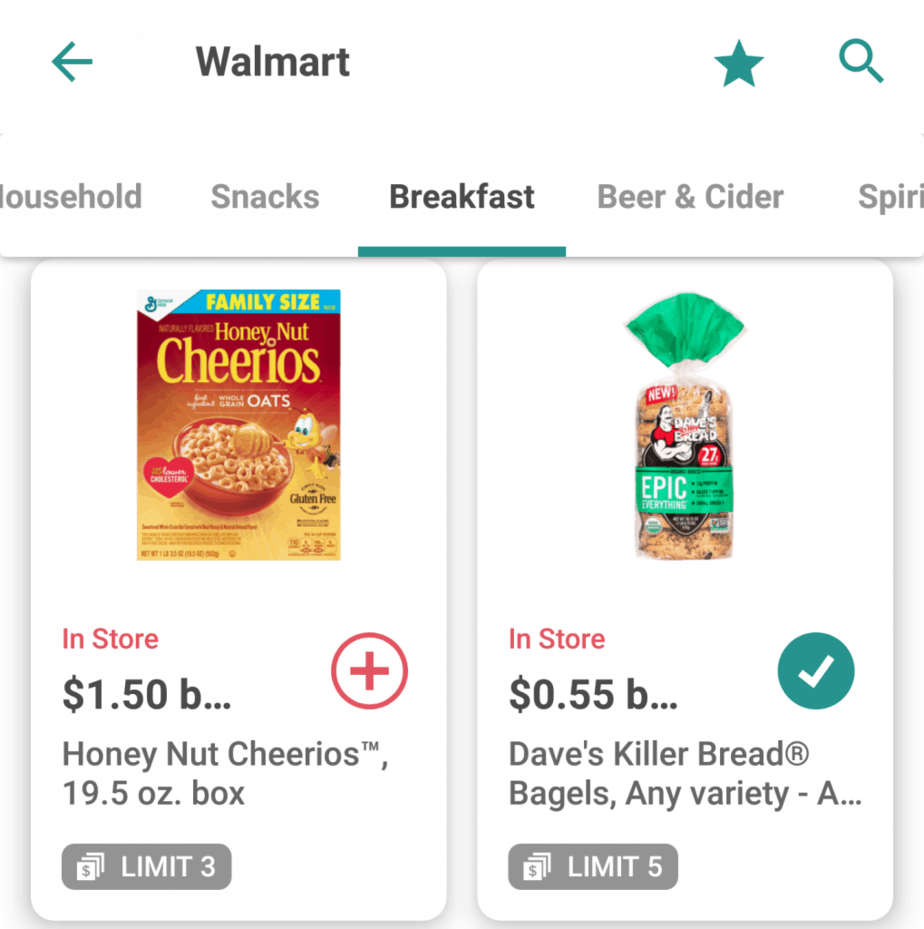

With each of these apps, you can add items to your in-app shopping list and scan your receipt after you purchase those items. Then, cash back or points are added to your app account, which you can usually cash out to PayPal.

Ibotta (pictured left): This app is my favorite because they also include regular incentives like an extra $5 for redeeming 5 offers in a week. Sign up for Ibotta here and get $5 free.

Fetch Rewards: Scan receipts from any grocery store. Sign up for Fetch Rewards here and enter Fetch code K6AAK for 2,000 sign-up points.

Checkout 51: Sort by retailer or category. Sign up for Checkout 51 and get $5 free.

The best part is that these apps operate separately, so you can use all three at once, even for the same product.

I like to browse the offers while I’m at the gym, on the bus, or watching TV, so it doesn’t add any extra time to my day.

Then, I upload my receipts as soon as I get home from the grocery store. I cash out a couple times a year and it’s always a nice bonus!

Get money back for online purchases

Shop through Rakuten to get money back from hundreds of stores. This includes necessities like baby supplies and tires for your car. Sign up for Rakuten here and get $10 free.

Link cards to automatic cash-back apps

Of all these options, this one is by far the easiest, because it requires no extra work on your end after you’ve set up the apps.

With these apps, you securely connect debit or credit cards, and whenever you make a purchase at one of the app’s retail partners, you automatically earn cash back.

Here are the two main apps that work this way:

Dosh: Partners include some grocery stores (e.g. 2% cash back at Sam’s Club), as well as retail stores and restaurants, both local and chains. Sign up for Dosh here and get $5 free when you link a card.

Drop: Much more limited than Dosh, at least for now. You can only pick 5 stores to connect for automatic rewards. Sign up for Drop here.

I started using both of these apps recently, but I love the concept of totally hands-off cash back. Your first passive income stream!

Pick Up a Side Hustle

So, maybe you’ve slashed your expenses as far as they can go, and you’re still struggling to make ends meet. In this case, the only other option for saving more is to earn more.

You can ask for a raise or extra hours at your main job, or you can use your free time to start a side hustle. I don’t think I can beat Peter’s side hustle ideas, so head to that article next to start brainstorming!

Other Ways to Find Helpful and Free Assistance for People and Families with Low Income

Kate is a writer and editor who runs her content and editorial businesses remotely while globetrotting as a digital nomad. So far, her laptop has accompanied her to New Zealand, Asia, and around the U.S. (mostly thanks to credit card points). Years of research and ghostwriting on personal finance led her to the FI community and co-founding DollarSanity. In addition to traveling and outdoor adventure, Kate is passionate about financial literacy, compound interest, and pristine grammar.

![How to Invest in Stocks for Beginners In 2025 [FREE Course] How to Invest in Stocks for Beginners In 2025 [FREE Course]](https://i.ytimg.com/vi/2NKmCQ-XfNc/maxresdefault.jpg)