Trading economics can be a complex and challenging field to master, but with the right strategies and approach, it is possible to become successful in this arena. Whether you are a beginner or an experienced trader, there are several key strategies that you can use to maximize your profits and minimize your risks. In this article, we will discuss some of the most effective strategies for mastering trading economics.

1. Stay Informed

One of the most important strategies for trading economics is to stay informed about current events and trends that may impact the markets. This includes keeping up to date with economic data releases, central bank announcements, political developments, and other news that could influence market sentiment. By staying informed, you can make more informed decisions about when to buy or sell assets, and when to stay on the sidelines.

2. Develop a Trading Plan

Having a clear and well-defined trading plan is essential for success in trading economics. Your trading plan should outline your goals, risk tolerance, entry and exit points, and other important factors that will guide your trading decisions. It is important to stick to your trading plan and not let emotions or impulses drive your trading decisions.

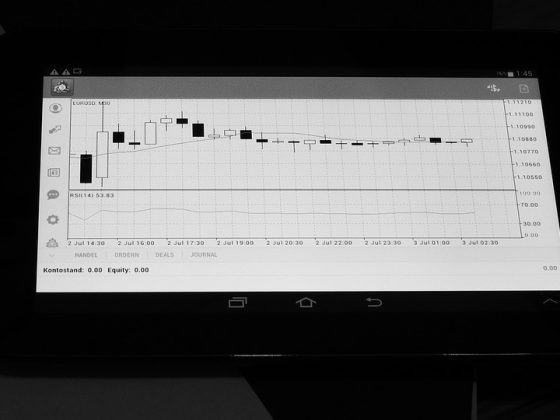

3. Use Technical Analysis

Technical analysis is a key tool for analyzing price movements and identifying trends in the markets. By using technical indicators and chart patterns, you can make more accurate predictions about future price movements and make better trading decisions. It is important to use a combination of technical and fundamental analysis to develop a well-rounded trading strategy.

4. Manage Risk

Risk management is a crucial aspect of trading economics, as no trader can avoid all risks completely. It is important to set stop-loss orders, limit your leverage, and diversify your portfolio to reduce the impact of potential losses. By managing your risk effectively, you can protect your capital and avoid significant losses.

5. Learn from Your Mistakes

One of the most important strategies for mastering trading economics is to learn from your mistakes. Every trader will experience losses at some point, but the key is to analyze your trades and identify any mistakes you may have made. By learning from your mistakes, you can improve your trading strategy and avoid making the same errors in the future.

6. Stay Disciplined

Discipline is essential for success in trading economics. It is important to stick to your trading plan, avoid making impulsive decisions, and not let emotions cloud your judgment. By staying disciplined and focused on your goals, you can avoid costly mistakes and increase your chances of success in trading economics.

7. Stay Patient

Trading economics can be a volatile and unpredictable field, and it is important to stay patient and not get discouraged by short-term losses. It is important to take a long-term view of your trading strategy and focus on consistent profits over time. By staying patient and maintaining a positive attitude, you can increase your chances of success in trading economics.

FAQs

Q: What is the best way to start trading economics as a beginner?

A: The best way to start trading economics as a beginner is to educate yourself about the markets, develop a trading plan, and start with a small amount of capital. It is important to start slowly and build your knowledge and experience over time.

Q: How much money do I need to start trading economics?

A: The amount of money you need to start trading economics will depend on your risk tolerance, trading strategy, and financial goals. It is important to start with an amount of money that you can afford to lose and gradually increase your capital as you gain more experience.

Q: What are the most common mistakes that traders make in trading economics?

A: Some of the most common mistakes that traders make in trading economics include letting emotions drive their trading decisions, not having a trading plan, and not properly managing their risks. It is important to avoid these mistakes and focus on developing a solid trading strategy.

In conclusion, mastering trading economics requires a combination of discipline, patience, and a solid trading strategy. By staying informed, developing a trading plan, using technical analysis, managing risk, learning from your mistakes, and staying disciplined and patient, you can increase your chances of success in trading economics. By following these strategies and staying focused on your goals, you can achieve long-term success in the trading arena.