Rising Housing Costs: The Housing Market Bubble and What it Means for Homebuyers

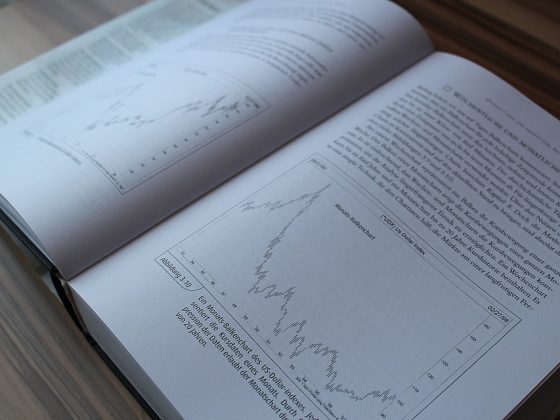

In recent years, the housing market has seen a significant increase in prices, leading to concerns about a potential bubble. The combination of low mortgage rates, limited supply, and high demand has driven up prices across the country, making it increasingly difficult for many individuals to afford a home. With rising housing costs, many potential homebuyers are left wondering what this means for them and how they can navigate the current market.

What is a housing market bubble?

A housing market bubble occurs when home prices rise significantly above their intrinsic value, driven by speculation and irrational exuberance. This leads to a rapid increase in prices that eventually surpasses what buyers are able to afford, causing the bubble to burst. When the bubble bursts, prices plummet, leading to foreclosures and financial instability in the housing market.

What factors contribute to rising housing costs?

Several factors contribute to rising housing costs, including:

– Low mortgage rates: Historically low mortgage rates have made it more affordable for buyers to purchase homes, leading to increased demand and higher prices.

– Limited supply: A lack of available homes for sale has created a competitive market, with more buyers than there are homes available, driving up prices.

– High demand: Strong demand from buyers, particularly first-time homebuyers and investors, has further fueled price increases.

– Urbanization: In urban areas, rapid population growth and limited space have led to higher housing costs as demand outstrips supply.

– Economic factors: Economic conditions, such as job growth and income levels, can also impact housing costs.

What does this mean for homebuyers?

For homebuyers, rising housing costs can make it more challenging to purchase a home. As prices continue to increase, affordability becomes a major concern for many individuals and families. This can lead to issues such as being priced out of the market, taking on larger mortgages, or delaying homeownership altogether.

What should homebuyers do in a rising market?

In a rising market, homebuyers should take several steps to navigate the current conditions:

– Determine your budget: Understand how much you can afford to spend on a home and stick to your budget to avoid overstretching yourself financially.

– Get pre-approved for a mortgage: Pre-approval can help you determine how much you can borrow and show sellers that you are a serious buyer.

– Work with a real estate agent: A knowledgeable real estate agent can help you navigate the buying process, find the right home, and negotiate the best deal.

– Consider alternative options: Explore different neighborhoods, property types, or financing options to find a home that fits your needs and budget.

– Be patient: In a competitive market, it may take time to find the right home. Be patient and don't rush into a purchase that you may regret later.

FAQs

Q: Will the housing market bubble burst?

A: While there is no way to predict the future with certainty, some economists and experts warn that the housing market may be in a bubble. However, others believe that the market is driven by strong fundamentals and will continue to grow steadily. It is important to monitor market conditions, stay informed, and make informed decisions when buying a home.

Q: Should I wait to buy a home?

A: Timing the market can be difficult, as it is impossible to predict when prices will peak or decline. If you are ready to buy a home and can afford it, it may be a good time to enter the market. However, if you are concerned about affordability or market conditions, it may be wise to wait and see how prices evolve.

Q: What can I do if I can't afford a home?

A: If you are unable to afford a home in the current market, there are several options to consider. You may explore renting, saving for a larger down payment, looking for more affordable areas, or considering alternative housing options such as co-living or shared ownership. Additionally, you can work on improving your credit score, reducing debt, and increasing your income to improve your financial standing.

In conclusion, rising housing costs have become a major concern for many homebuyers in the current market. With low mortgage rates, limited supply, and high demand driving up prices, affordability has become a key issue for individuals and families looking to purchase a home. By understanding the factors contributing to rising costs, taking proactive steps, and seeking professional guidance, homebuyers can navigate the market successfully and make informed decisions when buying a home.